Photo above: NFL breast cancer survivor celebration 2014.

Here’s a question I get asked a lot…

“Chris, of all the things you could be doing, why do you spend so much energy in the life insurance industry?”

It’s simple… Because it’s so exciting. 😉

(Watch the video below)

Seriously – Life insurance is not exciting. For most, it isn’t even the least bit interesting.

I have a personal story that may help answer the question for you…

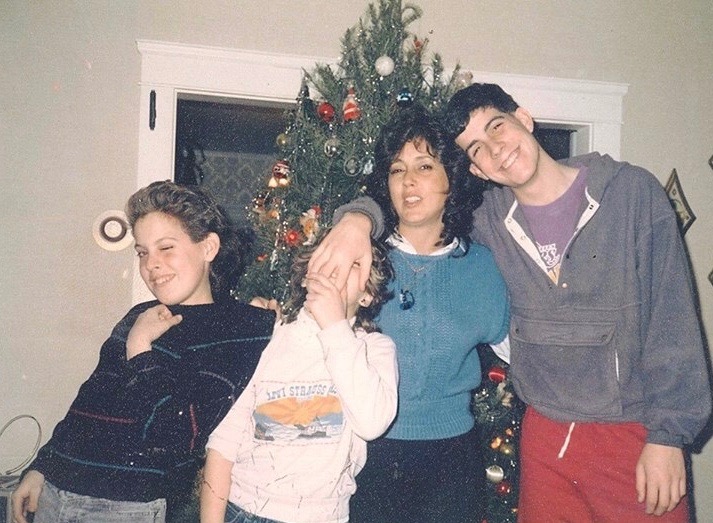

When I was young, my parents got divorced. A single mom raising three kids didn’t have a lot of money.

Goofing off in 1983

All that changed when my mother remarried. My stepfather, Tom was a very successful attorney. He moved my mom into a new home, with a pool. We went on nice vacations. Most of all, my mom was happy. Really happy.

Fast forward three years. I’m a freshman in college when I get a phone call…

“Tom’s in the hospital,“ my mom said. “Everything’s fine, finish your exams. Just wanted you to know.”

I’m glad I followed my instincts and went home. At the hospital, Tom told me he’d be fine. He said I was like another son to him and he told me he was proud of me.

The next day I went back to see him. And he was dead. At the age of 41.

It was devastating. My mom had finally found happiness. Then it was all gone …in an instant.

After the Christmas break, I went back to college. I graduated and got my first job as an actuary. One day I picked up a local newspaper and saw that my mother’s home was being foreclosed on.

I found that out… in the paper.

So I went to see her that night. Once again, it was much worse than I expected. Not only was the house in foreclosure, but she was also filing for bankruptcy.

Just starting my career I wasn’t in a position to help. My mom lost everything. Again. First, I had to watch her suffer emotionally. Now, I had to watch her suffer financially.

What makes this story worse was that I remembered years earlier, when Tom was in the hospital, my mom sent me to the house to get some things. I noticed lots of paperwork on the dining room table, which was unusual. On one of the stacks was a life insurance policy…. one they were about to purchase.

They had already done the paperwork, gone through underwriting, and simply needed to sign the policy and send it off with a check.

A check for an amount they never would have missed. They just didn’t get around to it.

“My mom was one insignificant check, and one 29 cent stamp, away from a completely different life! Instead she lost everything. And was helplessly plunged into her worst nightmare of returning to poverty.

This isn’t just a story about my mother. This is a story about America.

Life insurance has been in existence in the US for over 200 years. The basic concept is not rocket science. People pay a small amount of money, and if something tragic happens they receive a large amount of money from the insurance company.

Despite this simplicity, 80% of Americans admit they have no life insurance or are underinsured. How is this possible?

Some people give the insurance industry a bad rap. If 4 out of 5 people aren’t utilizing the products properly, how can you possibly disagree with them?

I’ve seen insurance save families and businesses. This is why we do what we do.

Worse, I’ve seen the absence of it have a devastating impact. Nobody needs to go through what my mother went through.

Now you have some insight into why I am passionate about this industry. And passionate about helping you See Differently and Business Differently.

(Subscribe here for insights and free resources)